Information silos are a nightmare! Vital financial and operational data is segregated based on corporate organization structures, suppliers, geography, and overarching relationships. These isolated groups of data can lead to decentralization and inhibit decision making leaving each plant to fend for themselves. History shows that conglomerates and large organizations have streamlined responsibilities to specific skills sets and work processes to be focused and efficient, but ultimately compound an inherit issue in the material handling supply chain. Take the example below.

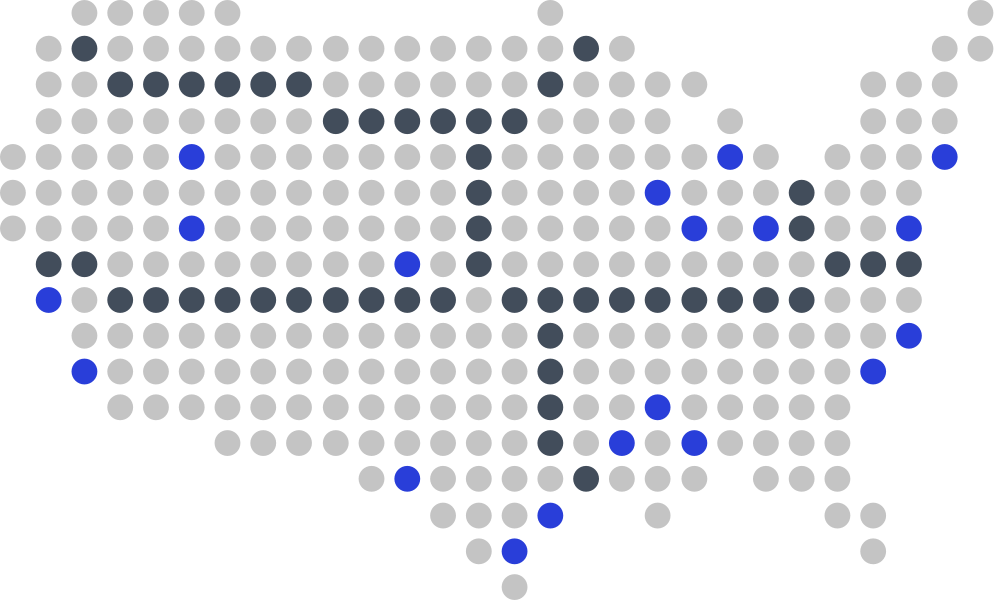

A company has twenty sites (blue dots) across the U.S. On average, those sites have thirty forklifts to total 600 MHE assets. Due to the different loads and environments, the corporate team has three national accounts with different OEMs, while the OEM’s dealer network generally operates in four (or more) territories (divided by the black dots). These (twelve plus) isolated dealers will be servicing the units throughout the unit’s lease term. And finally, the corporate team bids lessors every two years to improve pricing. That common recipe creates a myriad of unique data combinations required to evaluate each asset’s individual life cycle. A nearly impossible feat!

To simplify, we will look at an individual plant and break their roles into three basic groups: Finance, Operations, and Maintenance.

The finance team would be responsible for issuing purchase orders and paying invoices. Operations, including general management and team leaders, would dictate the fleet size, replacement planning, and service provider selection. The last group, maintenance, would include facility maintenance personnel or even equipment operators to handle day to day decisions and repairs. These three groups are constantly communicating directly and indirectly. For example, if a forklift breaks down and needs to be sent off-site for repair, maintenance will generate a work order that would need to be approved by operations and ultimately have a purchase order issued by finance.

While these groups operate in this manner, it is not optimal, and they do not have the resources available to readily retrieve historical statistics to make strategic decisions. Makeshift methods to bridge the data gap include spreadsheets and Google docs, but those do not scale, lack accuracy, and are deficient in reporting, let alone the effort to update them. Internal accounting or tracking software are too generalized to assess the pertinent details of each asset. Thus, it quickly becomes evident the importance of being able to add notes and monitor changes on a uniform platform as well as quickly break down the past spend and current trends to properly identify issues and allocate funding to the proper budgets.

That’s cool and it’s understandable, but how do I fix it? Propellr is designed specifically to weave together the separate silos of information and provide levels of detail to make the right business decisions. From a mountain of unreadable or inaccessible data to clear, available information that can be configured to your organization.

It starts with consolidating your enterprise data systems to identify what processes and systems are contributing to your company’s data silos, but then evolves into measurable changes within your company’s culture. Once complete, you will have a consistent strategy implemented throughout the organization.